| Подлежащее | |

| 1. Reading is useful | Чтение... |

| Часть сказуемого | |

| 2. Our aim is mastering English | ...овладеть... |

| Дополнение | |

| 3. She likes singing | ...пение |

| Определение | |

| 4. There are many ways of solving it | ...решения |

| Обстоятельство | |

| 5. He went there for studying. | ...учебы |

Герундиальные обороты

Prep. + Noun ( прит . п .) + Gerund

Pronoun ( прит .)

(Prep.) + N ( общ . п .) + Gerund

Example: He speaks of the workers’ (their) doing it.

...что рабочие сделают это.

7. Form gerunds using the suffix -ing:

read; explain; govern; create; develop; increase; provide; delivery; establish; distribute; visit; enter.

8. Make the following sentences simple using the Gerund:

1. Do you mind if I take your warranty card for a moment? 2. We must consider the matter thoroughly before we come to any conclusion. 3. I remember that we have seen our department head only once. 4. When he received another letter from his firm he changed his mind. 5. Before he left the office he called on his sales manager.

9. Translate the following sentences into Russian:

1. Cleaning up the river will require a major effort, and considerable expense. 2. Scientists’ working together and their sharing ideas with one another is of great advantage for science. 3. Economists have two ways of looking at economics and the economy. 4. Sellers compete by trying to produce the goods and services buyers want at the lowest possible price. 5. The next step in preparing a personal budget is to draw up a list of all your sources of income. 6. There are numerous reasons people think about owning a business of their own. 7. Instead of using that temporary opportunity to increase the market share for American autos by holding prices at current levels or lowering prices, the auto companies raised their prices. 8. Monetary policy refers to regulating the supply of money as a way of stabilizing the economy. 9. Ricardo is especially famous in international economies for demonstrating the advantages of free trade. 10. Hardly a day passes without hearing a commercial or reading an ad describing the advantages of one kind of program over another. 11. A firm of under 20 employees has a 37 percent chance of surviving four years. 12. Scientists’ constantly exploring the unknown, their looking for new knowledge and the answers to unsolved questions cannot be overestimated.

10. Try to understand the following song paying attention to the Gerund:

I LIKE HAVING A WALK

On Sunday afternoons in the middle of July

I like having a rest just looking at the sky.

I like listening to the birds singing in the trees

- In July...

I like having a walk when the sun shines.

And walking in the rain.

I love thinking of you and all the things you do

- On Sunday afternoons.

On rainy April Sundays I like staying at home.

I like reading a book or simply being alone.

I like watching a film or listening to some music

- In April...

11. Read the text and retell it in Russian:

David Ricardo (1772-1823) Classical Champion of Free Trade

David Ricardo is one of history's most influential economists. Born in England, Ricardo made a fortune on the London Stock Exchange. This wealth gave him the time to write and to serve in Parliament's House of Commons. His most famous work. Principles of Political Economy and Taxation (1817), marked him as the greatest spokesman for classical economics since Adam Smith.

Ricardo is especially famous in international economics for demonstrating the advantages of free trade. Free trade is a policy in which tariffs and other barriers to trade between nations are removed. To prove his point, Ricardo developed a concept we now call the principle of comparative advantage. Comparative advantage enabled him to demonstrate that one nation might profitably import goods from another even though the importing country could produce that item for less than the exporter.

Ricardo's explanation of comparative advantage went as follows:

Portugal and England, both of whom produce wine and cloth, are considering the advantages of exchanging those products with one another.

· x barrels of wine are equal to (and therefore trade evenly for) ó yards of cloth.

· In Portugal 80 workers can produces barrels of wine in a year. It takes 120 English workers to produce that many barrels.

· Portuguese workers can produce ó yards of cloth in a year. It takes 100 English workers to produce ó yards of cloth.

We can see, Ricardo continued, that even though Portugal can produce both wine and cloth more efficiently than England, it pays them to specialize in the production of wine and import English cloth. This is so because by trading with England, Portugal can obtain as much cloth for 80 worker-years as it would take 90 worker-years to produce themselves.

England will also benefit. By specializing in cloth, it will be able to obtain wine in exchange for 100 worker- years of labor rather than 120.

As a member of Parliament, Ricardo pressed the government to abandon its traditional policy of protection. Though he did not live to achieve that goal, his efforts bore fruit in the 1840's when England became the first industrial power to adopt a policy of free trade. There followed 70 years of economic growth during which the nation became the world's wealthiest industrial power.

Unit 13

Grammar: 1. Participle I

2. Причастные обороты.

3. Независимые причастные обороты.

I. Language Practice

1. Practise the fluent reading and correct intonation:

- `What do you `usually `do after work, Ann?

-Oh, a lot of things. There’s `always a `lot of `work to do about the house, washing up, doing the rooms, mending clothes.

- No, I `don’t `mean that. `What’s your `favourite pastime?

- Again - `nothing very special. Sometimes I read a little, watch TV or `listen to the music.

- `What’s your father’s hobby?

- He `enjoys carpentry, just making shelves, boxes, stools and so on.

- Oh, his `hobby `seems to be both interesting and useful for the house. By the way, do you know `what are the most `common `hobbies of Englishmen?

- Well, it `isn’t an easy question. As `far as I know, `many `Britishers like `sports and games, others, `gardening or `collecting `different things.

- I see. `What about dancing? Do you like it?

- Oh, very. Actually I’m crazy about dancing. `Do you `mean to `say we’ll `go to a dance?

- Yes, I’d like to. There’s a very good disco at the College Club.

2. Listen to the speaker; read and memorize the following words and phrases:

1. incorporate - регистрироваться

2. subchapter S - раздел в налоговом кодексе США, касающийся налогообложения малых корпораций

3. income tax - налог на прибыль, подоходный налог

4. to prorate - распределять пропорционально

5. returns - отчет, налоговая декларация

6. tax return - налоговая декларация

7. to incur - потерпеть убытки

8. retained earnings account - счет о нераспределенной прибыли

9. C-corporation - (амер.) частная компания с ограниченной ответственностью

10. tax rate - налоговая ставка

Text. Small Business in the USA: An S-Corporation is not always best

Small companies are generally believed to incorporate as S-corporations. S-corporations take their name from a Congressional addition to the income tax law known as subchapter S. The S-corporation enjoying many corporate attributes (the main is that the owners of a corporation do not expose their personal assets to corporate liability), it is treated like a partnership for purposes of determining its Federal income tax liability. At the end of each fiscal year, its total earnings (or losses) are prorated to each shareholder, and these earnings (or losses) are incorporated into their individual income tax returns.

Among the advantages of the S-corporation for small business is no "double taxation" - paying an income tax on corporate net income, and then paying an individual income tax on the dividend income subsequently distributed by the corporation.

Thus, the S-corporation "generally will not be liable for federal income tax." If losses are incurred during the start-up period (or any other period), these losses can be deducted each year from the shareholders' tax returns. All income, losses, credits, and deductions are "washed through" the S-corporation at the end of each fiscal year, and carried directly to the individual tax return for each shareholder. Being emptied out at the end of each fiscal year, the S-corporation has no retained earnings account.

For most of small businesses, the S-corporation has long been the preferred corporate structure. The operational accounting is simpler, and accounting, legal, and administrative expenses are minimized. Shareholders receive the immediate benefits of earnings without "double taxation". There are sound reasons to state that this is generally the most popular corporate structure.

However, for small businesses that are growing rapidly, the conventional C-corporation status may turn out to be more preferable. The primary motivation for such a change would be the ability to retain and reinvest earnings in the expanding business.

The maximum Federal income tax rate for C-corporation is 34 percent for taxable income up to $10.0 million, whereas the maximum tax rate on S-corporation income is now the maximum individual rate of 39.6 percent. If the business is striving to retain and reinvest all possible cash during a period of strong growth, it will obviously forgo distributing cash dividends thereby avoiding the problem of "double taxation."

II. Exercises on the Text:

3. Give English equivalents to:

корпоративные свойства; личное имущество; корпоративная ответственность, задолженность по федеральным налоговым платежам; финансовый год; общие поступления (или убытки); «двойное налогообложение»; «отмываются»; заносятся прямо в индивидуальную налоговую декларацию; операционный учет; бухгалтерские расходы; управленческие расходы; немедленная прибыль от доходов; серьезные причины; способность сохранить и инвестировать; доход, подлежащий налогообложению; оно очевидно откажется от распределения дивидендов наличными; учитывая влияние амортизационных отчислений.

4. Combine the words into sentences:

1. like, its, a partnership, is, Federal, it, liability, for purposes, income, of determining, tax, treated.

2. no, among, of the S-corporation, is, the advantages, «double taxation», for small business.

3. «washed through», all income, at the end, losses, of each fiscal year, credits, and deductions, are, the S-corporation.

4. the most popular, sound, are, to state, corporate structure, there, reasons, this, that, generally, is.

5. 34 percent, up to $10 million, income tax rate, is, the maximum, for taxable income, Federal, for C-corporation.

5. Sum up what the text says about:

the advantages of the S-corporation;

the charge to conventional C-corporation.

6. US government defines a small business as one that has fewer than 500 employees. Why do you think that most small business are in the service and retail fields?

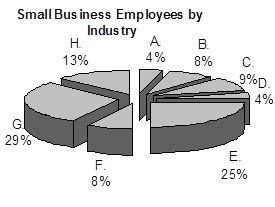

A. Transportation/Communication - taxi service, trucking, warehousing, radio station.

B. Finance - insurance, real estate, banking.

C. Wholesale - distributor, grain elevator.

D. Other - mining, landscaping, fishing, unclassified.

E. Service - motel, barber shop, advertising agency.

F. Manufacturing - machine shop, printing, brewing.

G. Retail - gas station, shoe store, restaurant, florist.

H. Construction - general constructor, plumbing and heating, electrical.

III. Grammar Exercises

Дата: 2019-07-31, просмотров: 324.